27 Jul 618 HALLMARK SALES: DOUYIN BECOMES A NEW MUST CONSIDER PLATFORM

618 is China’s second-largest online shopping festival running from late May until mid-June. As the first edition after the lifting of the pandemic, this year’s 618 has stirred fierce competition among the Chinese E-giants like T-MALL and Douyin, and the market tried to find the ‘wind vane’ for the future trajectory of Chinese E-commerce.

According to the market data, the total sales of the Traditional-Commerce platform reached $85 billion (614.3 billion yuan), with T-MALL occupying the top position, and JD following closely. However, despite the big market share, the y-o-y increase for the NO.1 T-Mall was only about 1.9%. As to the Live-Commerce platform, we saw the other way around. Douyin showcased exceptional performance during the 618 Shopping Festival and its sales doubled compared to the previous year, reaching over $8.45 billion.

The ‘wind vane’:

Traditional-Commerce such as T-MALL and JD still dominates the E-market but reaches a period of sluggish growth and almost approaches their maximum potential. However, Live-Commerce like Douyin and RED has entered a phase of rapid growth, particularly for the beauty and skincare category, the Live-Commerce platforms will be the main boosting engine in the future.

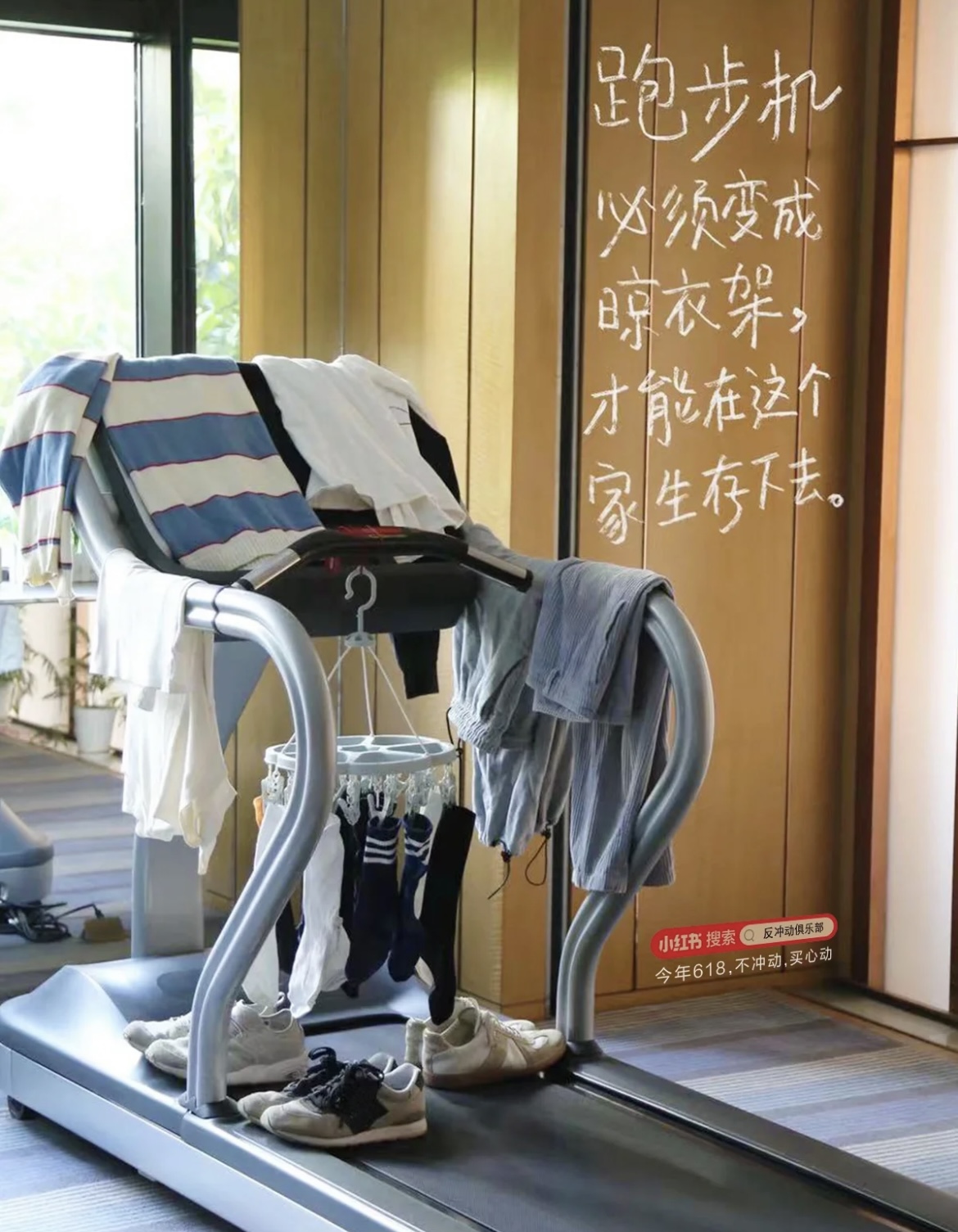

Stocking up is not a necessity

One of the major reasons for this growth difference is the decline in passion for stocking up. For Traditional-Commerce, the faltering of the Chinese economy after the pandemic has pushed consumers to be careful with spending so that people start to avoid excessive expenditure at one time. On top of that, the increasingly frequent brand promotions each month have weakened the lure for stocking up at major E-events. Consumers now tend to make discreet and regular purchases at different promotion points rather than spending extravagantly only during major E-commerce events.

Photos :RED Official; RED encourages users to consume rationally with inspiring posters

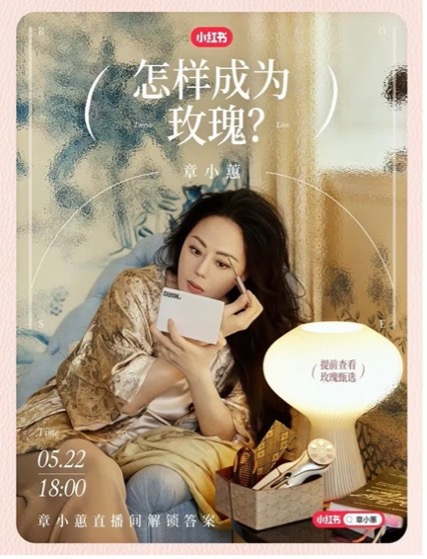

At the same time, Live-Commerce has been changing Chinese consumption behavior from ‘search and buy’ to ‘watch then buy‘, which acts as an efficient allure for shopping triggers. Especially on Douyin, which is now the biggest short video and streaming platform in China, people are into the ‘ZHONG CAO’ videos (Product Recommendation video by KOL or KOC) and streamings for daily goods like food, drinks, and garments, the whole shopping process is like entertainments.

Photos: The debut 618 streaming of@章小蕙 Zhang Xiaohui on RED achieved 50 million yuan turnover in the first 4 hours

The beauty sector is booming on Douyin

In terms of market share of the beauty sector among major E-commerce platforms for this 618, T-MALL is still the main battle that accounts for about 58% while Douyin is emerging and has reached 33%. To be specific, the makeup category of Douyin has experienced a remarkable y-o-y growth of over 90%, while the skincare category witnessed a y-o-y growth rate of over 54%, showing great potential.

Photos: @HR ranked first among the beauty brands at Douyin 618 with turnover over 300-million-yuan, following by @Estee Lauder as 2nd and @LA MER as 3rd

In the forward 2023, the market will still see promising opportunities for brands to enter Live-Commerce like Douyin and RED, not only for the masses but also for high-ends. As to the role of Traditional-Commerce platforms like T-MALL, it will still acts as the fundamental sales base but step by step evolves to the E-shelf for Live-Commerce platforms. Some consumers will directly make orders during the Douyin streaming, and some will compare price on T-MALL and JD.

Contact us to learn more about the different E-Commerce platforms in China

No Comments