Learnings from C-Beauty in 2024 – refresh

The Chinese Pulse’s refresh study helps global brands to better understand the evolving beauty landscape in China but also to get inspiration from C-beauty brands’ marketing strategies and best practices in make-up, skincare, haircare and fragrance industries.

It provides key learnings for global brands’ chinese strategy in terms of marketing positioning, digital & events communication and product offer.

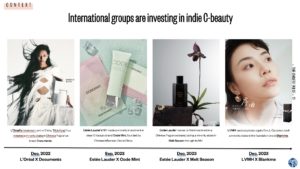

In a both dynamic and challenging Chinese beauty market, the local brands achieved an unprecedent growth in 2023. The sales of C-beauty products increased by 21.2% year-on-year and their market share reached 50.4%, surpassing international brands for the first time*. C-beauty brands rely on more mature supply chains, rich and agile R&D and very advanced online & offline communication achieving to meet the expectations and seduce the sophisticated Chinese consumers.

After a first insightful edition in 2021, TCP team has worked on an updated and refreshed version of Learning from C-beauty for 2024.

CONTENT

Context: background and evolution of the past years of C-Beauty brands

1_ 4 different types of C-Beauty brands

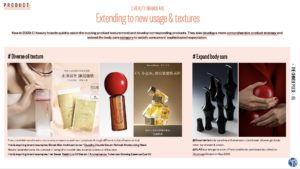

2_ C-Beauty best practices strategies

3_ C-Beauty latest aesthetic trends

Key take-outs for international brands : how to adapt to those emerging competitors on a local and global scale ?

# METHOLOGY

- A deep dive into 90 C-Beauty brands (Skincare, Make-up, Fragrance & Haircare

- TCP analysis of the C-Beauty Brands best practices in 2021: product offer, digital activations, collabs’, events and experiences etc..

- A qualitative screening of the chinese social medias and UGC (user generated content)

- Desk research / Outsource datas analysis

FORMAT : PDF _ 100 pages appr. with words and images*

* Images non free of rights / For internal use only

PRICE : 3,800 euros HT (including a 1h call with TCP expert)

Cover picture : Photographer @Zakk然 / magazine Cosmopolitan Jan 2023